inheritance tax rate in michigan

The day that you make a gift in excess of 325000 that would be as a chargeable lifetime transfer with inheritance tax paid upfront at half the usual rate of 40 so 20 of 175000 is payable in inheritance tax on day one. Requesting an extension of time to file does not extend the deadline for paying any tax due.

Is Your Inheritance Considered Taxable Income H R Block

Any payment made when you file your tax return is subject to interest and penalty may be due.

. A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases. Giving money away if you need care. If you then died within 7 years the balance 20 would be payable as well.

You should file for a federal andor state extension of time to file prior to the tax deadline. The amount of the tax is in proportion to the amount subject to taxation. Please note this form only allows you to file your tax return after the original due date April 15.

Proportional describes a distribution effect on income or expenditure referring to the way the rate remains consistent does not progress from low to high or high.

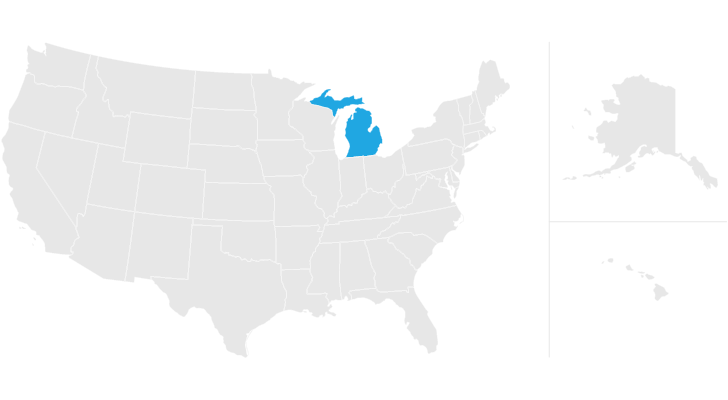

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Tax Explained Rochester Law Center

Taxing Inheritances Is Falling Out Of Favour The Economist

401 K Inheritance Tax Rules Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxing Inheritances Is Falling Out Of Favour The Economist

State Estate And Inheritance Taxes Itep

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Where Not To Die In 2022 The Greediest Death Tax States

State Estate And Inheritance Taxes Itep